In the complex world of corporate governance, the board of directors plays a pivotal role in shaping an organization's future, ensuring its financial health, and maintaining ethical standards. As businesses face increasingly complex challenges in a rapidly evolving global marketplace, understanding the functions and responsibilities of a board of directors has become more crucial than ever.

This comprehensive guide delves into the multifaceted role of the board, exploring its composition, key responsibilities, and the evolving nature of corporate governance in today's business landscape.

Also Read:

Introduction to the Board of Directors

At the heart of every well-functioning corporation lies a group of individuals tasked with overseeing the company's operations and safeguarding the interests of its stakeholders. This group is known as the board of directors, and its importance in corporate governance cannot be overstated.

Definition of a Board of Directors

A board of directors is a body of elected or appointed members who jointly oversee the activities of a company or organization. These individuals are typically elected by shareholders in a for-profit corporation or appointed by members in a non-profit organization. The board acts as a fiduciary for shareholders, making decisions on their behalf and ensuring that the company's leadership acts in the best interests of its stakeholders.

Importance of the Board of Directors

The board of directors serves as the cornerstone of corporate governance, playing a crucial role in several key areas:

- Strategic Direction: The board is responsible for setting the overall direction of the company, including its vision, mission, and long-term goals.

- Oversight: Directors provide oversight of the company's management, ensuring that executives are performing their duties effectively and ethically.

- Financial Stewardship: The board is accountable for the company's financial health, including approving budgets and ensuring accurate financial reporting.

- Risk Management: Directors are tasked with identifying and mitigating potential risks to the company's operations and reputation.

- Stakeholder Relations: The board acts as a bridge between the company and its various stakeholders, including shareholders, employees, and the community at large.

By fulfilling these responsibilities, the board of directors helps to ensure the long-term success and sustainability of the organization.

Roles of the Board of Directors

The board of directors carries a wide range of responsibilities that are critical to the success and longevity of an organization. These roles encompass strategic planning, oversight, financial management, and risk assessment.

Overview of Board Responsibilities

The primary responsibilities of a board of directors can be broadly categorized into four main areas:

- Strategic guidance

- Oversight of management

- Financial oversight

- Risk management

Each of these areas requires careful attention and expertise from board members to ensure the company's success and compliance with legal and ethical standards.

Strategic Guidance

One of the most crucial roles of the board is to provide strategic guidance to the organization. This involves setting the overall direction of the company and ensuring that it remains competitive and relevant in its industry.

Setting Company Vision and Mission

The board is responsible for establishing and periodically reviewing the company's vision and mission statements. These statements serve as guiding principles for the organization, informing decision-making at all levels. For example, a technology company's board might set a vision of "Revolutionizing communication through innovative software solutions," which would then guide the company's strategic decisions and product development efforts.

Establishing Long-term Goals

In addition to setting the vision and mission, the board works with executive management to establish long-term goals for the organization. These goals typically span several years and are designed to drive the company's growth and success. For instance, a board might set goals such as:

- Achieving a 20% market share in key product categories within five years

- Expanding operations into three new international markets by 2025

- Reducing the company's carbon footprint by 50% over the next decade

By setting these long-term goals, the board provides a framework for management to develop more detailed operational plans and strategies.

Oversight of Management

Another critical role of the board is to provide oversight of the company's management team, ensuring that they are acting in the best interests of the organization and its stakeholders.

Evaluating CEO and Executive Performance

The board is responsible for hiring, evaluating, and, if necessary, terminating the Chief Executive Officer (CEO). This includes setting performance expectations, conducting regular performance reviews, and determining appropriate compensation. The board also oversees the performance of other key executives, often through reports from the CEO and direct interactions during board meetings.

For example, a board might evaluate a CEO based on criteria such as:

- Financial performance metrics (e.g., revenue growth, profitability)

- Strategic goal achievement

- Leadership effectiveness and employee satisfaction

- Stakeholder relations

Approving Major Business Decisions

While day-to-day operations are managed by the executive team, the board is responsible for approving major business decisions that could significantly impact the company's future. These decisions might include:

- Mergers and acquisitions

- Major capital expenditures

- Entry into new markets or product lines

- Significant changes in corporate structure or strategy

For instance, if a company is considering a $500 million acquisition of a competitor, the board would be heavily involved in reviewing the proposal, assessing the risks and potential benefits, and ultimately deciding whether to approve the transaction.

Financial Oversight

Ensuring the financial health and integrity of the organization is a key responsibility of the board of directors.

Budget Approval

The board is responsible for reviewing and approving the company's annual budget. This process typically involves:

- Reviewing management's proposed budget

- Asking questions and seeking clarification on various line items

- Ensuring the budget aligns with the company's strategic goals

- Making recommendations for adjustments if necessary

- Formally approving the final budget

For example, if a company's strategic goal is to expand into new markets, the board would expect to see increased marketing and research and development expenses reflected in the budget.

Financial Reporting and Compliance

The board plays a crucial role in ensuring the accuracy and integrity of the company's financial reporting. This includes:

- Overseeing the audit process

- Reviewing and approving financial statements

- Ensuring compliance with accounting standards and regulations

- Monitoring internal financial controls

For instance, the board's audit committee might meet regularly with external auditors to review financial statements and discuss any areas of concern. They would also be responsible for ensuring that the company complies with regulations such as the Sarbanes-Oxley Act in the United States, which sets standards for financial reporting and corporate governance.

Risk Management

In today's complex business environment, effective risk management is essential for long-term success and sustainability.

Identifying and Mitigating Risks

The board is responsible for working with management to identify potential risks to the organization and develop strategies to mitigate these risks. This might include:

- Conducting regular risk assessments

- Reviewing and approving risk management policies and procedures

- Ensuring adequate insurance coverage

- Overseeing cybersecurity measures

For example, a board might identify climate change as a significant risk to the company's supply chain. In response, they could direct management to develop a strategy for diversifying suppliers and investing in more resilient infrastructure.

Ensuring Legal Compliance

The board must ensure that the company operates within the bounds of the law and adheres to ethical standards. This involves:

- Staying informed about relevant laws and regulations

- Establishing and enforcing a code of ethics

- Overseeing compliance programs

- Addressing any legal or ethical violations promptly

For instance, if a company operates in multiple countries, the board would need to ensure compliance with various international laws, such as anti-corruption regulations and data privacy standards.

Composition of the Board of Directors

The effectiveness of a board of directors is largely dependent on its composition. A well-structured board brings together diverse perspectives and expertise to guide the organization effectively.

Board Structure

The structure of a board can vary depending on the size and nature of the organization, but certain principles are generally applicable.

Size and Composition

The size of a board can range from a handful of members to over 20, though most public companies have boards with 8-12 members. The optimal size should balance the need for diverse expertise with the ability to make decisions efficiently.

The composition of the board typically includes:

- Independent directors (not employed by or closely affiliated with the company)

- Executive directors (usually including the CEO and sometimes other top executives)

- Non-executive directors (may have some affiliation with the company but are not employees)

For example, a board of 10 members might include:

- 7 independent directors

- 2 executive directors (CEO and CFO)

- 1 non-executive director (former executive or major shareholder)

Diversity and Inclusion

Increasingly, boards are recognizing the importance of diversity in terms of gender, ethnicity, age, and professional background. A diverse board brings a range of perspectives and experiences, which can lead to more robust decision-making and better representation of stakeholder interests.

For instance, a technology company might aim to have a board that includes:

- Directors with expertise in technology, finance, marketing, and human resources

- A mix of genders and ethnicities reflective of the company's global customer base

- A range of ages to balance experience with fresh perspectives

Roles of Individual Board Members

While the board functions as a collective body, individual members often take on specific roles and responsibilities.

Chairperson

The chairperson (or chair) leads the board and plays a crucial role in its effectiveness. Responsibilities typically include:

- Setting the agenda for board meetings

- Facilitating discussions and ensuring all voices are heard

- Serving as a liaison between the board and management

- Leading the evaluation of the CEO and other board members

In some companies, the roles of chairperson and CEO are separated to ensure a balance of power and independent oversight.

Secretary

The board secretary, who may or may not be a board member, is responsible for:

- Maintaining board records and minutes

- Ensuring compliance with legal and regulatory requirements

- Managing board communications

- Organizing board meetings and logistics

Treasurer

The treasurer, often chairing the finance or audit committee, focuses on:

- Overseeing financial reporting and budgeting processes

- Ensuring the integrity of financial controls

- Liaising with external auditors

- Advising the board on financial matters

Committee Members

Most boards operate with a committee structure to handle specific areas of responsibility. Common committees include:

- Audit Committee: Oversees financial reporting and internal controls

- Compensation Committee: Determines executive compensation and benefits

- Nominating and Governance Committee: Manages board composition and governance policies

- Risk Committee: Focuses on risk management and compliance

Committee members are typically chosen based on their expertise in the relevant area. For example, the audit committee might include directors with accounting or financial management backgrounds.

Hiring and Compensation

One of the board's most critical responsibilities is overseeing the hiring and compensation of top executives, particularly the CEO.

Executive Recruitment

The process of hiring a new CEO or other top executives is one of the most important tasks a board can undertake, as these decisions can significantly impact the company's future direction and success.

Process of Hiring Executives

The executive hiring process typically involves several steps:

- Defining the role and required qualifications

- Forming a search committee

- Engaging an executive search firm (often for CEO searches)

- Reviewing candidates and conducting interviews

- Performing background checks and due diligence

- Making a final selection and negotiating terms

For example, when hiring a new CEO, a board might:

- Develop a detailed job description outlining required experience, skills, and leadership qualities

- Engage a top executive search firm to identify potential candidates

- Conduct multiple rounds of interviews, including one-on-one meetings with board members and group discussions

- Arrange for finalists to present their vision for the company

- Perform extensive background checks and reference calls

- Negotiate compensation and other terms of employment

Setting Compensation

Determining appropriate compensation for executives is a complex and often controversial aspect of board responsibilities.

Compensation Packages for Executives

Executive compensation typically includes several components:

- Base salary

- Annual bonus or short-term incentives

- Long-term incentives (e.g., stock options, restricted stock units)

- Benefits and perquisites

- Severance and change-in-control provisions

When setting compensation, boards must balance the need to attract and retain top talent with the responsibility to use company resources wisely and align executive interests with those of shareholders.

For instance, a board might structure a CEO's compensation package as follows:

- Base salary: $1 million per year

- Annual bonus: Up to 150% of base salary, based on specific performance metrics

- Long-term incentives: $5 million in restricted stock units vesting over 4 years

- Benefits: Standard package plus additional life and disability insurance

- Severance: 2 years of base salary and target bonus if terminated without cause

Boards often engage compensation consultants to provide market data and advice on structuring executive pay packages. They must also consider factors such as company performance, industry benchmarks, and shareholder sentiment when making compensation decisions.

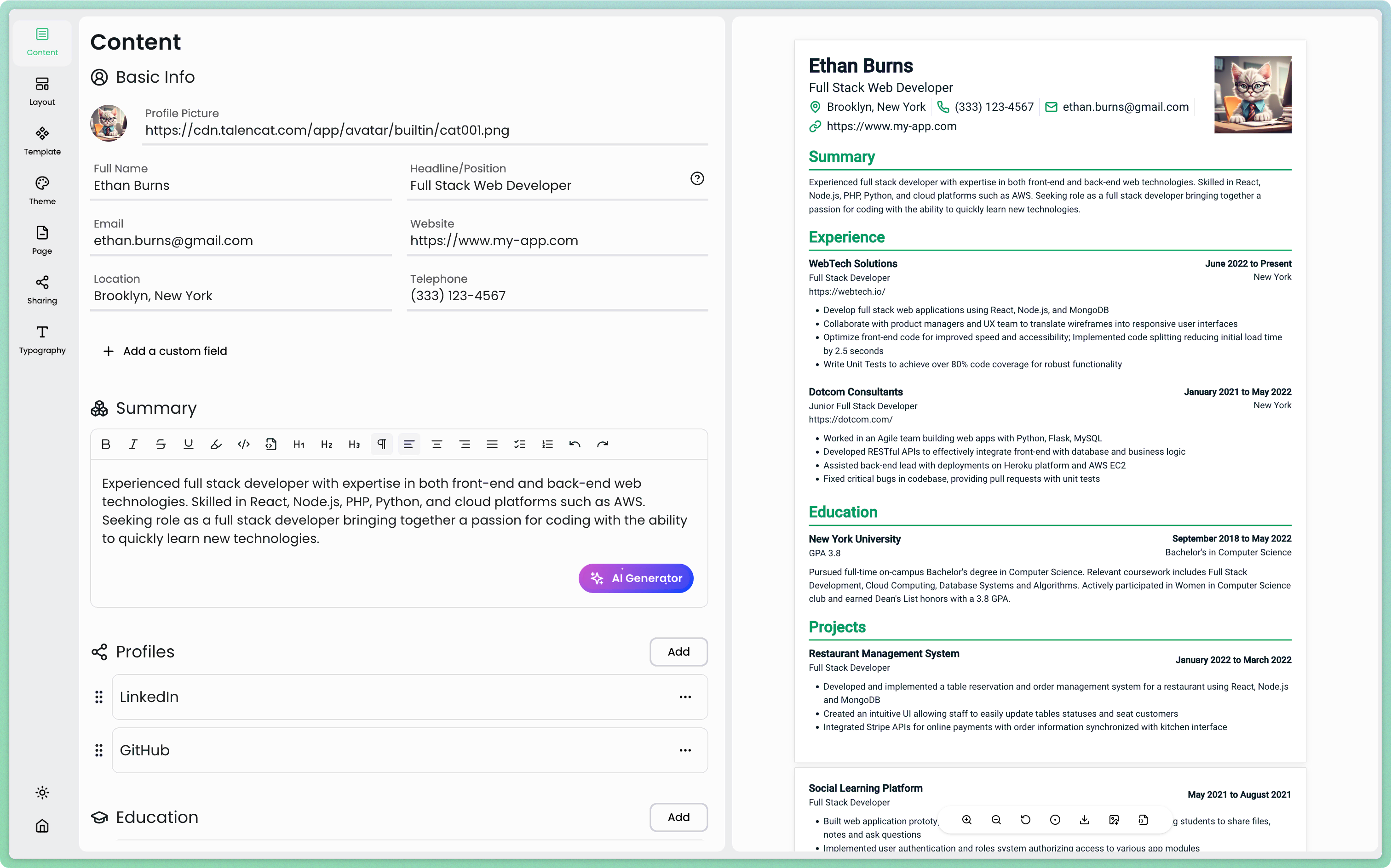

Crafting a Board of Director Resume with TalenCat CV Maker

For aspiring board members or seasoned directors looking to update their professional profile, TalenCat CV Maker offers an excellent solution to create a compelling Board of Director resume. This user-friendly platform provides tailored templates and AI-powered assistance to showcase your leadership experience and corporate governance expertise.

Follow these steps to craft a standout Board of Director resume:

Step 1: Log in to TalenCat CV Maker and initiate your resume creation process by clicking the "+ Create Resume" button in the top right corner.

Step 2: Choose a name for your Board of Director resume and select either "Create" for a blank slate or "Create with Example" for a pre-filled template tailored to board positions.

Step 3: Utilize the intuitive editor to input your board experience, corporate achievements, and governance skills. The real-time preview on the right panel allows you to visualize your resume as you build it.

Step 4: Leverage TalenCat's AI-powered features to enhance your resume content. The platform can suggest improvements and help you highlight key accomplishments relevant to board positions.

Once you've perfected your Board of Director resume, you can easily export it as a PDF or image file. For a more dynamic approach, consider enabling the "online share" feature to generate a shareable link, perfect for networking with other executives or submitting to board recruitment committees.

Remember, a well-crafted Board of Director resume should emphasize your strategic vision, financial acumen, and ability to navigate complex corporate landscapes. TalenCat CV Maker provides the tools and templates to ensure your resume stands out in the competitive world of corporate governance.

Board Meetings

Frequency and Structure of Meetings

The frequency of board meetings can vary depending on the organization's needs and circumstances. Typically, boards meet quarterly, with additional meetings as needed for urgent matters or special projects. Some key aspects of board meeting structure include:

- Regular meetings: Usually scheduled well in advance, covering routine business and ongoing strategic discussions.

- Special meetings: Called to address urgent issues or make time-sensitive decisions.

- Annual meetings: Often coinciding with shareholder meetings, focusing on long-term planning and board elections.

- Committee meetings: Held separately to focus on specific areas of responsibility.

For example, a typical board meeting schedule might look like this:

- Quarterly full board meetings (March, June, September, December)

- Monthly executive committee calls

- Bi-monthly audit committee meetings

- Annual strategic planning retreat (October)

- Annual shareholder meeting (May)

Preparing for Meetings

Effective board meetings require thorough preparation by both directors and management.

Agenda Setting

The board chair, often in consultation with the CEO and committee chairs, is responsible for setting the meeting agenda. A well-structured agenda might include:

- Call to order and approval of previous meeting minutes

- CEO report on company performance and key initiatives

- Committee reports (e.g., audit, compensation, governance)

- Discussion of strategic issues or major decisions

- Executive session (without management present)

- Any other business and adjournment

Reviewing Supporting Materials

Directors are expected to review all relevant materials before the meeting. These typically include:

- Financial reports and performance metrics

- Management presentations on key issues

- Committee reports and recommendations

- Background information on topics for discussion or decision

For instance, if the board is considering a major acquisition, directors might receive a detailed information packet including:

- Financial projections for the combined entity

- Due diligence findings

- Market analysis and strategic rationale

- Proposed integration plan

- Risks and mitigation strategies

Meeting Documentation

Proper documentation of board meetings is crucial for legal compliance, institutional memory, and effective follow-up.

Minutes and Record Keeping

The board secretary is typically responsible for taking minutes during the meeting. These minutes should:

- Record attendance and any conflicts of interest declared

- Summarize key discussions and decisions made

- Note any dissenting opinions or abstentions on votes

- Document any actions to be taken and assignments made

For example, minutes for a board decision on a new product launch might include:

"After a thorough discussion of the market opportunity and potential risks, the board voted unanimously to approve the launch of Product X, with a budget of $10 million for initial production and marketing. Director Smith emphasized the need for close monitoring of early sales data, and management agreed to provide weekly updates to the board for the first three months post-launch."

Proper record-keeping also involves maintaining a secure archive of all board materials, including agendas, minutes, and supporting documents.

The Relationship Between the Board and Stakeholders

The board of directors serves as a critical link between the company and its various stakeholders, including shareholders, employees, customers, and the broader community.

Engaging with Shareholders

Effective shareholder engagement is essential for maintaining investor confidence and support. Boards typically interact with shareholders through:

- Annual general meetings

- Quarterly earnings calls and investor presentations

- One-on-one meetings with major institutional investors

- Written communications, such as annual reports and proxy statements

For example, a board might organize an annual "Investor Day" event where directors and executives present the company's long-term strategy and answer questions from analysts and major shareholders.

Communicating with Employees

While the board doesn't typically interact directly with employees on a day-to-day basis, it plays a crucial role in shaping company culture and ensuring effective communication. This might involve:

- Periodic town hall meetings where board members address employees

- Reviewing and approving internal communication strategies

- Ensuring management has effective channels for employee feedback

- Overseeing succession planning and leadership development programs

For instance, a board might require quarterly reports on employee engagement survey results and hold management accountable for addressing any areas of concern.

Collaborating with Other Stakeholders

Boards are increasingly recognizing the importance of considering a broader range of stakeholders in their decision-making. This might include:

- Engaging with local communities where the company operates

- Collaborating with industry partners on shared challenges (e.g., sustainability initiatives)

- Participating in policy discussions with government officials

- Considering the impact of company decisions on customers and suppliers

For example, a board might establish a sustainability committee to oversee the company's environmental and social impact initiatives, engaging with environmental groups and local communities to develop and implement these programs.

Challenges Facing Boards of Directors

As the business landscape evolves, boards face a number of challenges in fulfilling their responsibilities effectively.

Navigating Complexity in Governance

The increasing complexity of global business operations, regulatory requirements, and stakeholder expectations creates significant challenges for boards. Some key areas of complexity include:

- Cybersecurity and data privacy

- Environmental, Social, and Governance (ESG) issues

Addressing Conflicts of Interest

Boards must be vigilant in identifying and managing conflicts of interest that may arise among directors, executives, and stakeholders. This involves:

- Establishing clear policies and procedures for disclosing conflicts

- Ensuring that independent directors are involved in decision-making where conflicts exist

- Regularly reviewing and updating conflict of interest policies

Ensuring Accountability

The board is responsible for holding management accountable for performance and ethical conduct. This includes:

- Setting clear performance metrics and expectations

- Conducting regular evaluations of management performance

- Implementing mechanisms for reporting and addressing unethical behavior

Evolving Role of the Board of Directors

As the business environment continues to change, the role of the board of directors is also evolving.

Trends in Governance Practices

Boards are increasingly adopting best practices in governance, including:

- Enhanced transparency and disclosure practices

- Greater focus on diversity and inclusion in board composition

- Increased engagement with stakeholders on ESG issues

Adaptation to New Business Environments

Boards must be agile and responsive to changes in the business landscape, including:

- Technological advancements and digital transformation

- Shifts in consumer behavior and market dynamics

- Regulatory changes and emerging risks

Conclusion

Summary of Key Points

The board of directors plays a critical role in corporate governance, overseeing management, ensuring financial integrity, and engaging with stakeholders. As the business landscape evolves, boards must adapt to new challenges and expectations.

The Future of Board Governance

Looking ahead, the future of board governance will likely involve greater emphasis on diversity, stakeholder engagement, and proactive risk management, ensuring that boards are well-equipped to navigate the complexities of modern business.