Market making is a crucial aspect of financial markets, providing liquidity and facilitating smooth trading operations. For those aspiring to enter this field, understanding the intricacies of market making interview questions is essential. This comprehensive guide will explore various aspects of market making interviews, providing insights into common questions, strategies for success, and tips for preparation.

Introduction to Market Making Interviews

Market making interviews are designed to assess a candidate's understanding of financial markets, their ability to think quickly under pressure, and their aptitude for managing risk. These interviews often combine technical knowledge with practical problem-solving skills.

Overview of Market Making

Market making involves providing liquidity to financial markets by continuously quoting buy and sell prices for financial instruments. Market makers play a crucial role in maintaining market efficiency and stability.

Importance of Interviews in Market Making

Interviews are a critical part of the hiring process for market making positions. They allow firms to evaluate a candidate's technical knowledge, problem-solving abilities, and cultural fit within the organization.

Types of Market Making Firms

Market making firms can range from large investment banks to specialized proprietary trading firms and hedge funds. Each type of firm may have slightly different interview processes and focus areas.

Common Market Making Interview Questions

General Questions

What is Market Making?

Sample Question: "Can you explain what market making is and its role in financial markets?"

Expert Answer: Market making is the process of providing liquidity to financial markets by continuously quoting both buy and sell prices for financial instruments. As a market maker, our role is to facilitate trading by being willing to buy or sell assets at any time, thereby ensuring that investors can always find a counterparty for their trades. This process helps to maintain market efficiency, reduce price volatility, and ensure smooth market operations.

Explain Bid-Ask Spread

Sample Question: "What is the bid-ask spread, and why is it important in market making?"

Expert Answer: The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for an asset. It's crucial in market making because it represents the primary source of profit for market makers. We buy at the bid price and sell at the ask price, with the difference being our potential profit. The spread also reflects the liquidity and risk of the asset – tighter spreads generally indicate higher liquidity and lower risk.

How Do Market Makers Manage Risk?

Sample Question: "What are some key strategies market makers use to manage risk?"

Expert Answer: Market makers employ several strategies to manage risk. These include maintaining a balanced inventory to minimize exposure to price fluctuations, using sophisticated pricing models to accurately value assets, implementing hedging strategies to offset potential losses, and employing strict risk management protocols. Additionally, we continuously monitor market conditions and adjust our positions accordingly to maintain an optimal risk profile.

Technical Questions

Explain the Market Making Process

Sample Question: "Walk me through the basic process of market making for a stock."

Expert Answer: The market making process for a stock involves continuously quoting bid and ask prices. We start by assessing the stock's current market price, recent trading activity, and overall market conditions. Based on this analysis, we set our bid and ask prices, typically slightly below and above the current market price, respectively. We then submit these quotes to the exchange. As trades occur, we adjust our inventory and update our quotes accordingly. This process is ongoing, with constant monitoring and adjustment to maintain an optimal position and manage risk.

What Models are Used in Market Making?

Sample Question: "Can you discuss some common models used in market making?"

Expert Answer: Market makers use various models to inform their decision-making. Some common ones include the Black-Scholes model for options pricing, stochastic volatility models for more complex derivatives, and time series models for predicting price movements. We also use inventory-based models to manage our positions and risk exposure. Additionally, many firms develop proprietary models that incorporate machine learning and big data analytics to gain a competitive edge in pricing and risk management.

Discuss Liquidity and Its Importance

Sample Question: "Why is liquidity important in financial markets, and how do market makers contribute to it?"

Expert Answer: Liquidity is crucial in financial markets as it allows for efficient price discovery, reduces transaction costs, and enables investors to enter or exit positions quickly without significantly impacting the market price. Market makers contribute to liquidity by always being ready to buy or sell assets, even in times of market stress. This constant presence helps to smooth out price fluctuations and ensures that there's always a counterparty for trades, which is essential for maintaining investor confidence and market stability.

Scenario-Based Questions

Make a Market on an Unknown Quantity

Sample Question: "Make a market on the number of trees in Central Park."

Expert Answer: While I don't have the exact number, I can provide a reasonable estimate. Given Central Park's size and density, I'd estimate there are between 500,000 to 700,000 trees. To make a market, I'd start with a bid of 550,000 and an ask of 650,000. This spread accounts for my uncertainty while still providing a reasonable trading range. I'm willing to adjust these quotes based on any additional information or trading activity.

Estimate a Spread for a Given Scenario

Sample Question: "What spread would you quote for a newly listed tech stock with high volatility?"

Expert Answer: For a newly listed tech stock with high volatility, I would quote a wider spread to account for the increased risk and uncertainty. Assuming the stock is trading around $50, I might start with a bid of $49.75 and an ask of $50.25, representing a 1% spread. This wider spread provides a buffer against rapid price movements while still allowing for active trading. As more information becomes available and trading patterns emerge, I would adjust the spread accordingly.

How Would You Adjust Your Quotes?

Sample Question: "If you're making a market and suddenly receive news that could impact the asset's price, how would you adjust your quotes?"

Expert Answer: Upon receiving market-moving news, I would immediately widen my spread to protect against potential losses while I assess the information. I'd quickly analyze the news to determine its likely impact on the asset's price. If it's positive news, I'd raise both my bid and ask prices, maintaining a wider spread until the market stabilizes. For negative news, I'd lower both prices. Throughout this process, I'd closely monitor order flow and competitor quotes, adjusting my own quotes dynamically to maintain a competitive position while managing risk.

Probability and Estimation Questions

Market Making on Prime Numbers (Example)

Sample Question: "Make a market on the number of prime numbers between 1 and 100."

Expert Answer: To approach this, I'll use my knowledge of prime numbers and estimation skills. There are 25 prime numbers between 1 and 100. However, in a real market-making scenario, I wouldn't know this exact figure. I'd estimate it's around 20-30. To make a market, I'd start with a bid of 22 and an ask of 28. This spread reflects my uncertainty while still providing a reasonable trading range. I'm prepared to adjust these quotes based on trading activity or any additional information provided.

How Many People Live in India? (Example)

Sample Question: "Make a market on the population of India, with a maximum spread of 100 million."

Expert Answer: Based on my knowledge of global demographics, I estimate India's population to be around 1.3 to 1.4 billion. To make a market with a maximum spread of 100 million, I'd quote a bid of 1.35 billion and an ask of 1.45 billion. This spread accounts for potential variations in recent population growth while staying within the specified range. My confidence level is moderate, as population figures can change rapidly, but I believe this range captures the likely current population.

Estimate the Price of a Commodity

Sample Question: "Estimate the current price of gold per ounce and make a market for it."

Expert Answer: Based on recent market trends, I estimate the current price of gold to be around $1,800 per ounce. To make a market, I'd start with a bid of $1,795 and an ask of $1,805. This narrow spread reflects gold's status as a highly liquid commodity. My confidence in this range is relatively high due to gold's global importance and the frequency of its trading. However, I'm prepared to adjust these quotes quickly in response to any significant market news or trading activity.

TalenCat: Master Market Making Interview Questions

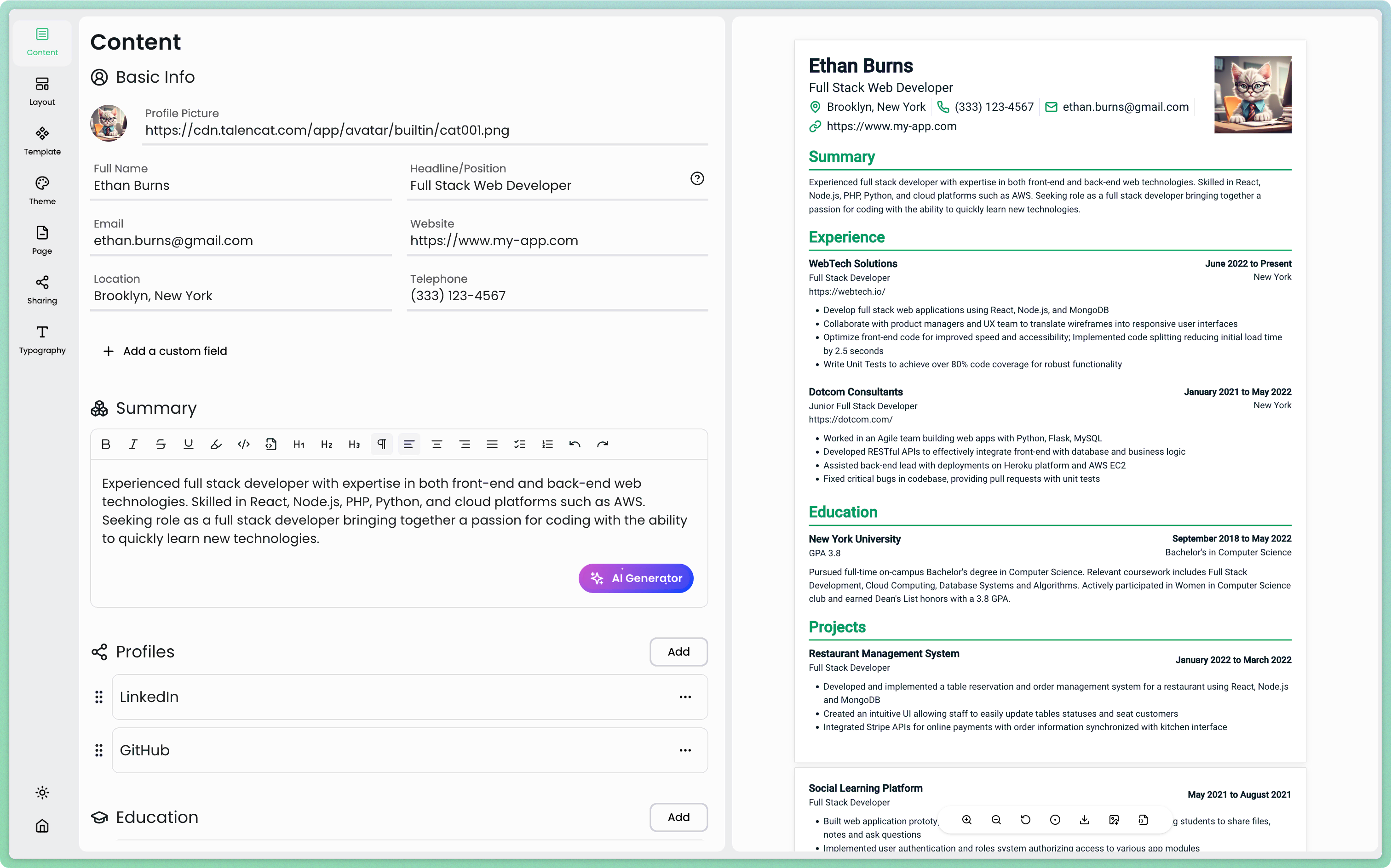

Preparing for a market making interview can be challenging, but with TalenCat CV Maker, you can streamline your preparation process and gain a competitive edge. This AI-powered online resume builder not only helps you create a professional resume but also assists you in anticipating potential interview questions specific to market making roles.

Here's how to use TalenCat CV Maker to prepare for your market making interview:

Step 1: Log in to TalenCat CV Maker and create or upload your market making resume.

Step 2: Navigate to the "AI Assistant" section and select "Interview Assistant" from the left-side menu. This powerful feature will analyze your resume content specifically for market making positions.

Step 3: Click "Analyze Now" to generate tailored interview questions based on your market making experience and skills.

Step 4: Review the generated questions and prepare your responses. These questions will likely cover topics such as risk management, trading strategies, market dynamics, and your experience with financial instruments.

Step 5: Use the AI-powered resume editor to refine your resume based on the interview questions, ensuring your experience aligns with potential discussion points.

By leveraging TalenCat CV Maker's Interview Assistant, you'll be well-prepared to tackle challenging market making interview questions, showcasing your expertise and increasing your chances of landing that coveted position.

Remember, thorough preparation is key to success in any interview, especially in a competitive field like market making. TalenCat CV Maker provides you with the tools to stand out and demonstrate your value to potential employers.

Advanced Market Making Interview Techniques

Preparing for Market Making Games

Strategies for Success

Market making games require quick thinking and strategic decision-making. To succeed, candidates should:

- Maintain composure under pressure and avoid emotional decisions

- Practice mental math for rapid calculations

- Develop a systematic approach to pricing

- Keep track of positions and overall exposure

- Learn to recognize patterns in market behavior

- Build resilience to handle losses and market swings

- Focus on long-term profitability rather than individual trades

Common Scenarios to Practice

- Trading simulation with volatile assets

- Market making during news events

- Managing multiple positions simultaneously

- Dealing with sudden market movements

- Handling large order flows

- Adapting to changing market conditions

- Risk management in extreme scenarios

Leveraging Technology in Market Making

Tools and Software Used

- Trading platforms (Bloomberg Terminal, Reuters Eikon)

- Risk management systems

- Market data analytics tools

- Automated trading systems

- Position tracking software

- Real-time market monitoring tools

- Pricing models and calculators

- Historical data analysis platforms

Importance of Data Analysis

- Using historical data to identify patterns

- Implementing quantitative models for pricing

- Analyzing market microstructure

- Monitoring trading volumes and liquidity

- Tracking market sentiment indicators

- Evaluating competitor behavior

- Measuring trading performance metrics

- Developing predictive analytics

Post-Interview Strategies

Following Up After Interviews

- Send a thoughtful thank-you note within 24 hours

- Reference specific discussion points from the interview

- Express continued interest in the role

- Provide any additional requested information promptly

- Maintain professional communication throughout the process

- Follow up appropriately if no response is received

- Keep networking with industry professionals

Reflecting on Performance

- Review answers to technical questions

- Analyze handling of market making scenarios

- Identify areas for improvement

- Document challenging questions for future preparation

- Assess strategic thinking during games

- Evaluate communication effectiveness

- Consider feedback received during the interview

Continuous Learning and Improvement

- Stay updated with market trends and news

- Participate in trading forums and communities

- Attend industry conferences and seminars

- Read relevant financial publications

- Practice market making simulations regularly

- Develop new trading strategies

- Build network within the industry

- Pursue relevant certifications

- Enhance technical and analytical skills

Conclusion

In conclusion, market making interviews are a rigorous and multifaceted process designed to evaluate candidates' deep understanding of financial markets, their ability to manage risk, and their capacity to think strategically under pressure. The comprehensive guide provided here delves into the various aspects of market making interviews, offering insights into common questions, strategies for success, and tips for preparation. From explaining the basics of market making and the importance of the bid-ask spread to tackling technical questions and scenario-based challenges, candidates must demonstrate a blend of technical expertise and practical problem-solving skills.

The guide also highlights the significance of interviews in the hiring process for market making positions, emphasizing the need for firms to assess not only technical knowledge but also problem-solving abilities and cultural fit. Different types of market making firms, ranging from large investment banks to specialized proprietary trading firms and hedge funds, may have varying interview processes and focus areas, requiring candidates to tailor their preparation accordingly.

Moreover, the guide underscores the importance of thorough preparation, suggesting the use of tools like TalenCat CV Maker to streamline the process and gain a competitive edge. By leveraging AI-powered interview assistants, candidates can anticipate potential questions specific to market making roles and refine their resumes to align with these discussion points.